FTC COMPLIANCE TRAINING

protect your dealership from legal headaches while maintaining ethical standards and prioritizing data protection and consumer rights.

Sounds like a dream, right? Well, it’s not. That’s dealer compliance working as intended.

Below, we will dive into the complexities of dealership compliance regulations. But don’t worry; we’ve got you covered with insights on navigating this ever-changing landscape effectively.

Before We Dive In:

This document is not meant to constitute legal advice.

This is a suggested guide for all automotive dealers who want to ensure their files and operations are up-to-date regarding legal requirements. It provides reminders for ongoing and periodic legal needs and offers a straightforward way to audit their legal “health.” Moreover, it can help trigger actions that might have been overlooked.

Implementing secure development practices is crucial in this industry. We’ll give you some ideas on managing your vendors and properly implementing transparent encryption solutions. Plus, we’ll explore the importance of designating qualified individuals to oversee compliance management within your organization.

Compliance does not have to be a hindrance; it can be an enhancement to your business by increasing the level of professionalism in your staff. A sound compliance program will project organizational confidence, increasing the customer’s level of desire to do business with you.

We’ll also discuss the ECOA and its role in creating a fair lending environment. You’ll learn how to stay within legal parameters while fostering a culture prioritizing fairness and compliance.

Don’t let dealer compliance be a source of stress – join us on this journey, and let’s put data protection and consumer rights at the top of our priority list.

Understanding Dealer Compliance Regulations

NADA’s Annual Update on Federal Regulations states that auto dealerships must navigate a complex landscape of federal and state laws, including 104 different rules and regulations such as the GLBA Safeguards Rule, Used Car Rule, ECOA, Red Flags Rule, Regulation Z disclosure requirements for credit terms, and OSHA standards on workplace safety.

Overview of Key Dealership Regulations

- The GLBA Safeguards Rule: Protects customer data from unauthorized access or misuse.

- The Used Car Rule: Mandates that used car dealers display a Buyer’s Guide in every vehicle they offer for sale.

- The Equal Credit Opportunity Act (ECOA): Prohibits discrimination when evaluating potential borrowers’ applications.

- The Red Flags Rule: Requires businesses offering credit to implement an identity theft prevention program.

- Obligations under Regulation Z: Impose various disclosure requirements related to credit terms offered by auto dealerships.

Maintaining Up-to-Date Compliance Knowledge

Staying current with ever-changing legislation is crucial for auto dealerships. Fortunately, resources like the National Automobile Dealers Association (NADA) and the American International Automobile Dealers Association (AIADA) provide regulatory updates, industry news, and best practices for dealers to access. Bottom Line Driven stays current on this ever-changing landscape to keep your personnel informed and up-to-date.

Leverage Technology Solutions for Your Dealership Training & Compliance requirements.

With the ComplyAuto suite of products, automotive dealership compliance professionals can access your customized, up-to-date training content and materials in one central location. It also provides expiration notifications, so you know when certifications or other requirements need to be updated before expiration. This ensures your staff is always compliant, eliminates the chance of costly mistakes due to outdated information, and creates a streamlined process that saves time and money while ensuring your staff is always informed of the latest requirements and regulations.

Equipping staff with knowledge and tools can help organizations minimize unnecessary risk and promote a culture of compliance. Empowering teams better equips them to manage challenges and embrace opportunities while consistently adhering to policies and procedures.

Secure Development Practices for Auto Dealerships

Auto dealerships must adopt secure development practices to comply with federal and state dealer laws, including the newer amendments to the GLBA Safeguards Rule. Creating written documentation outlining policies to secure all written and digital data streams is essential.

Plus, you must consider the following:

Proper Vendor Management

Establish a robust vendor management program that includes regular risk assessments, due diligence checks, and ongoing monitoring of security measures implemented by vendors.

Transparent Encryption Solutions

Adopt encryption technologies to protect sensitive data against unauthorized misuse and ensure compliance.

- Step 1: Review and improve vendor management processes.

- Step 2: Research transparent encryption solutions for additional protection.

- Step 3: Train employees on best practices for handling confidential information and maintaining compliance.

Designating Qualified Individuals

for Compliance Management

Dealerships must comply with new regulatory guidelines by appointing qualified personnel to oversee compliance programs. These individuals must possess expertise in IT requirements, vulnerability testing, access control measures, and employee training to ensure smooth compliance.

Roles & Responsibilities in Managing Dealership Compliance

Designated individuals must exhibit comprehensive awareness of applicable laws and regulations while keeping policies up to date, monitoring changes, maintaining communication, and conducting regular audits.

Training Employees Across Departments

To achieve effective compliance management, it’s crucial to provide ongoing training on various topics. This includes Used Car Rule requirements, ECOA obligations, data security best practices, and recognizing red flags for identity theft or fraud. By staying informed and equipped with the proper knowledge, businesses can ensure that they operate ethically and within legal boundaries.

ECOA: Ensuring Fair Lending Practices

Don’t discriminate. The Equal Credit Opportunity Act (ECOA) prohibits discrimination based on various factors when evaluating loan applications. Adhere to ECOA regulations to avoid penalties and maintain a trustworthy business environment.

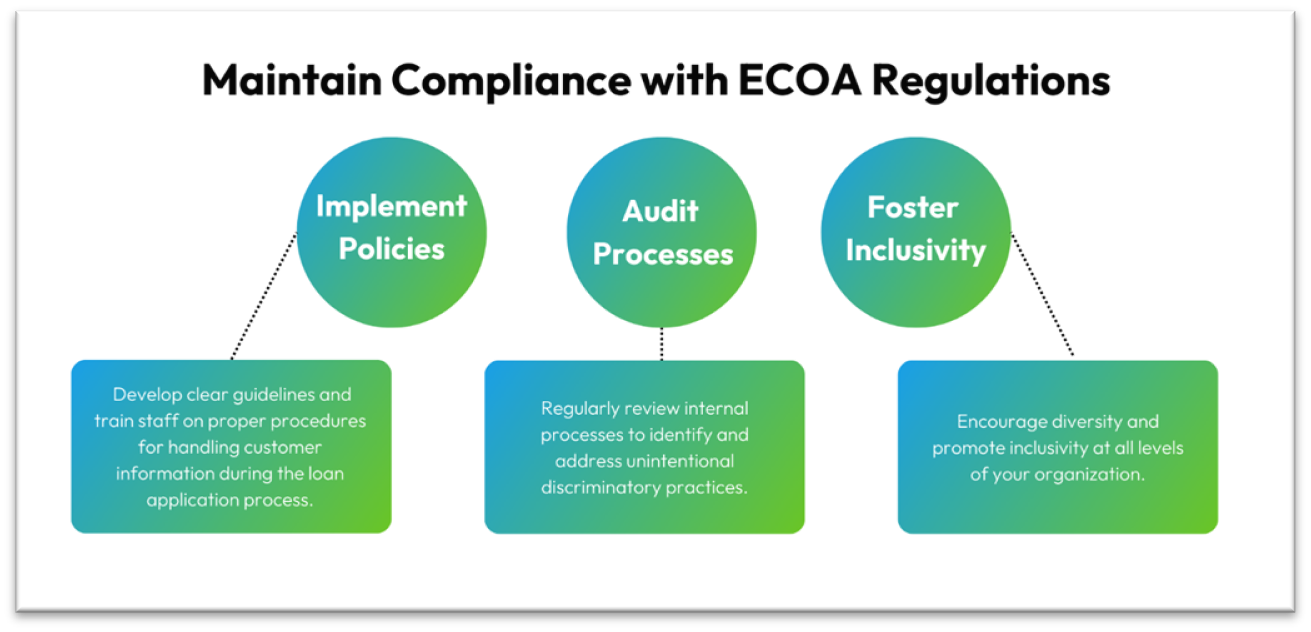

Maintain Compliance with ECOA Regulations

- Implement Policies: Develop clear guidelines and train staff on proper procedures for handling customer information during the loan application process.

- Audit Processes: Regularly review internal processes to identify and address unintentional discriminatory practices.

- Foster Inclusivity: Encourage diversity and promote inclusivity at all levels of your organization.

faqs about dealer compliance

What is the FTC Safeguard Rule for dealerships?

The Federal Trade Commission FTC Safeguards Rule requires automotive and car dealerships to implement a comprehensive information security program to protect customer data.

What is Red Flag Compliance for auto dealers?

Red Flag Compliance refers to the Red Flags Rule under FACTA, which mandates that businesses like auto dealerships develop an Identity Theft Prevention Program.

What are the FTC's proposed car dealer rules?

The FTC’s proposed car dealer rules aim to provide more transparent consumer protection information about warranty coverage, as well as vehicle history reports during pre-sale inspections.

What is OFAC in dealerships?

OFAC (Office of Foreign Assets Control) enforces economic sanctions programs against targeted foreign countries, terrorists, drug traffickers & other threats.

Are you FTC Compliant?

Dealer compliance is no laughing matter – it can be the difference between the success and failure of a dealership. Staying up-to-date with regulations is crucial, but it’s also necessary to implement secure development practices and assign qualified individuals to manage compliance strategy.

The good news is that Bottom Line Driven can help make things easier. We are well-equipped to meet your compliance needs with our partnership with ComplyAuto and our propriety training modules.

From Dealer Principals and General Managers to front-line staff, everyone plays a vital role in ensuring compliance within your dealership. So, don’t risk legal action – take compliance seriously and reap the benefits in the long run. Contact our team today to discover how we can help you succeed.